H&r Block Online Chat - You can trust the integrity of our impartial, independent financial advice. However, we may receive compensation from the publishers of some of the products featured in this article. Opinions are solely the author's. This content is not provided, reviewed, endorsed or approved by any advertiser except as otherwise stated below.

H&R Block has long been a trusted name in affordable tax preparation. In addition to having more than 11,000 offices spread throughout the United States, they have the ability to file their own tax forms.

H&r Block Online Chat

What's new this year and what level of H&R Block online software might best suit your needs? See this review for details.

Online Tax Filing Services & E File Tax Prep

If you've used H&R Block in the past, you'll notice that several new features and services have been added to H&R Block customers. Here's what's new for 2020 (2019 tax year).

In the past, getting H&R Block tax return information was little or no hope. Their do-it-yourself online software was their most affordable option, while Tax Pro Go was a good choice for clients looking to outsource tax preparation to a tax professional.

But this year, H&R Block is launching its new Online Assist program - which seems to strike a good balance between the other two programs. Online Assist is available as an add-on to all H&R Block online products for an additional $40 to $60. Customers who pay for Online Assist can get help from tax professionals, CPAs or enrolled agents at any time.

H&R Block tax experts are available via chat, screen share or phone. Also remember that filers can still use a Tax Professional Review (for an additional fee) before submitting their return.

Useful Tools When You File Your Taxes With H&r Block

As in previous years, H&R Block is offering a cash back bonus for customers who put part of their refund on an Amazon gift card. This year the Amazon gift card promotion is worth a 4% cash back bonus.

Here's how it works. If you owe a refund, you can designate a portion of the refund (in $100 increments up to $9,000) to be transferred to an Amazon gift card, as opposed to direct deposit or other payment methods.

H&R Block will give you a free 4% bonus on any amount you choose to load onto your Amazon card. So, for example, if you use $250 of your cash back to buy an Amazon gift card, H&R Block will load another $10 onto the card.

Depending on the size of your refund, you can get a big bonus with a gift card. But remember that gift cards are not as flexible as cold, hard cash. Buy only Amazon gift cards in bulk that you can actually use without changing your regular spending habits.

H&r Block Tax Software Deluxe Homeowners/investors 2014

H&R Block has four plans for its online software: Free, Deluxe, Premium, and Self-Employed. Let's take a closer look at the key features and prices of each version.

The free DIY version of H&R Blocks includes e-filing your federal and state taxes. Even the free tier allows you to submit your W-2s for certain employers. And even if you can't directly import your W-2, their quick image import feature will get you up and running quickly.

H&R Block can automatically import a previous year's tax return if you used another provider. Of course, it will also save your income every year if you have used this software before.

Plus, the free version automatically imports your corporate credentials for your state taxes. He will ask you a few more questions and submit your state taxes for free. That is a huge advantage. Many other installation software options are free of federal taxes, but charge a large fee for installation of state taxes.

H&r Block Review 2022: Pros And Cons

One of the great things about H&R Block is that they offer live chat support for customers using the free version of their software. Chat support is available to everyone whether you pay for Online Assist or not.

H&R Block claims that the free version of their software includes more tax forms than their TurboTax competitor. Some of the tax situations handled by their free version include the earned income tax credit, child care expenses, student loan interest, retirement plan income, Social Security income, and the child tax credit.

If your taxes are basic, including various types of income, but very few deductions or credits, this may be the level you want to file. Remember, if you need to add more forms after launch, you can always upgrade.

Deluxe offers all the same benefits as Free plus a few extra features. The main difference (besides the price) between the versions is that the Deluxe includes more forms of capture. If you have a Health Savings Account (HSA) or pay property taxes or mortgage interest in 2019, you will need to upgrade to the Deluxe Edition.

Credit Karma Tax Vs. H&r Block: Which Is Better For Filing Taxes?

In addition to other forms, Deluxe includes several other benefits. For example, DeductionPro helps you boost your charitable giving. You also get access to tax refunds for up to six years.

Finally you get more support with Deluxe. While the free version comes with chat support, Deluxe customers can also talk to support representatives over the phone. It currently costs $29.99 for a state filing and $36.99 for a state return.

Premium includes everything in Deluxe, plus additional support for income and expenses from rental properties, cost basis for home sales, gifts, inheritances and more.

It is best suited for those who need to use Schedule C-EZ to report simple business income and deductions. Plus, you'll be able to import expenses from several of the most popular tracking apps.

H&r Block Vs. Turbotax Vs. Jackson Hewitt

Side hustlers with less than $5,000 in self-employment or contractor income can probably get by with Premium. But if you earn more than that per year as a self-employed person, you will probably want to choose a self-employment plan.

Premium includes a Schedule D to report investment income from stocks, bonds and other investments. It also allows you to determine the cost basis of home sales, dividends, gifts and inheritances, as well as import costs in other popular applications.

The premium version of H&R Block now costs $49.99 for state filings and $36.99 for state returns. This is a great opportunity to get all these forms available.

This option is ideal for self-employed individuals whose income and expenses are more complex on Schedule C-EZ, or for owners of rental properties. It comes with all the forms from the other options, but it also includes a full Schedule C form.

Emerald Card Prepaid Mastercard

After you provide H&R Block with your key income and expense numbers, they will help you accurately report your business's profit or loss. And they'll search high and low to help you take advantage of every single business expense or deduction you're entitled to, and help you navigate some complicated situations like property depreciation.

Got an Uber side hustler? If so, you'll love H&R Block Self-Employed. If you pay for this version, you can directly import your Uber benefits (1099-K, 1099-MISC) from your driver account. Currently, H&R Prevent Self-Employment costs $79.99 for the 2019 tax season and $36.99 for state returns.

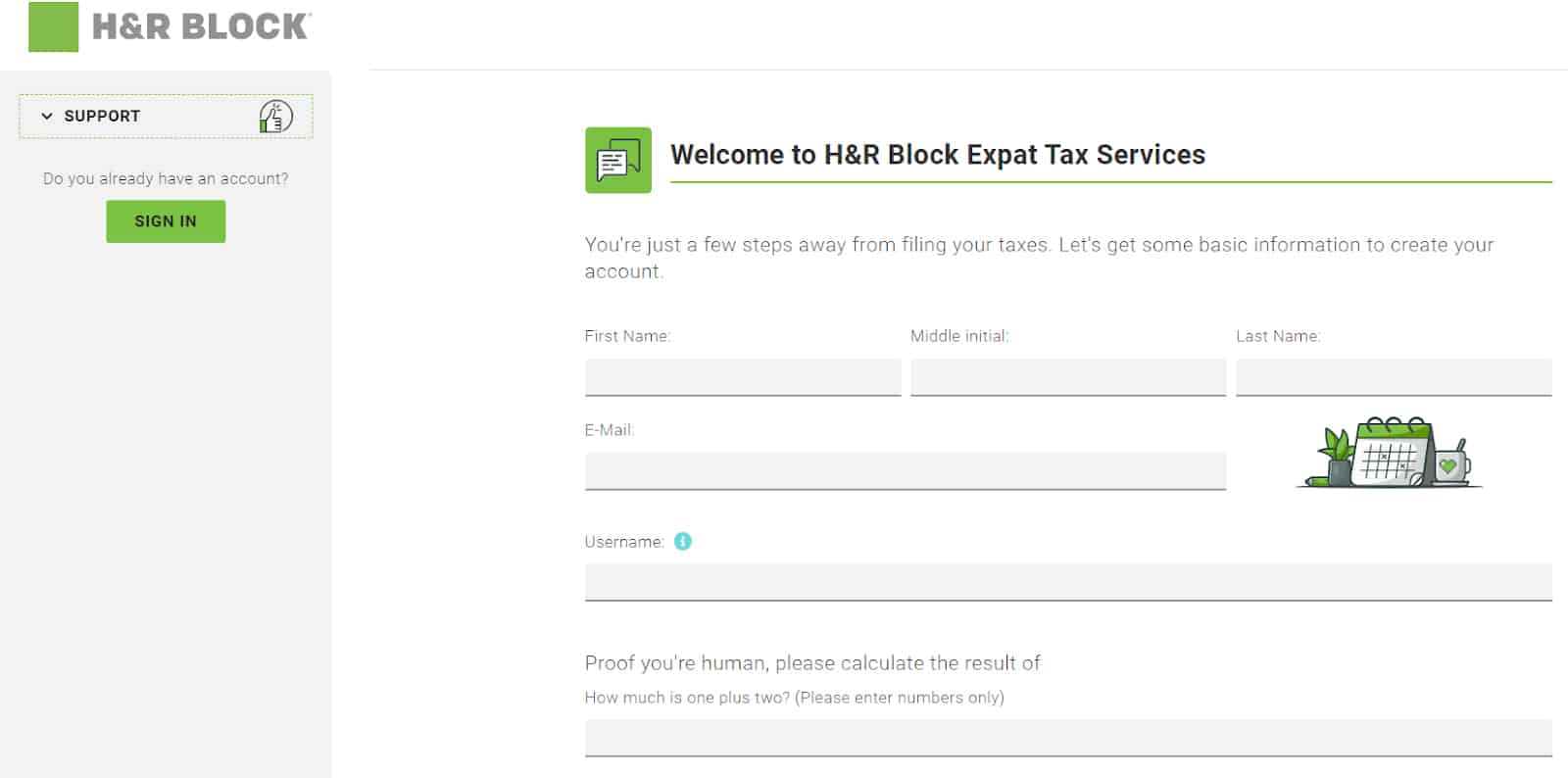

Registering an account with H&R Block is easy. I didn't notice any other security measures except that I had to set three authentication questions and meet their password parameters.

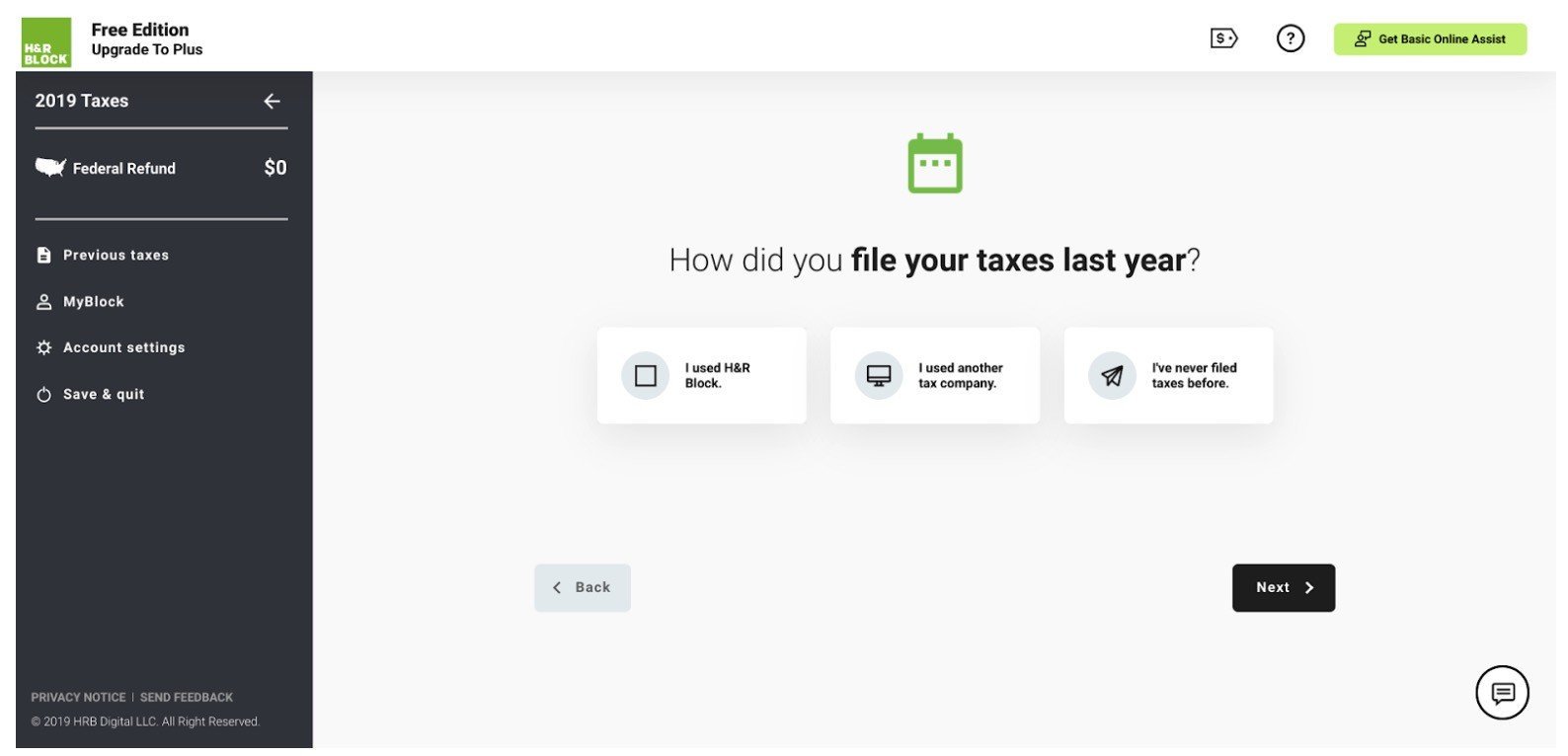

If you select "I used H&R Block," you can automatically import your previous year's return. And even if you choose "I used another company," H&R Block makes it easy to switch by letting you upload your 1040.

H&r Block Review 2023: Make Tax Preparation Easy

H&R Block's software looks similar to TurboTax in many ways. A clean design that divides your navigation into six main sections: Your Information, Income, Deductions, Debts, Taxes, and Summary.

And like TurboTax, H&R Block uses a question-and-answer style format to guide you through the entire tax filing process.

If I choose an income form that is not part of the free version I am currently using, the software will let me know how to upgrade it.

Since you don't have to pay until the end of the process, you can keep adding forms as needed, and when you're done submitting, you'll pay for the lowest possible version. Also, H&R Block's latest pricing tool means that whenever you decide to upgrade your version, you'll get a notification informing you of the current total termination rate.

Online Tax Assistance

When I get to the end of my fake income log, he asks me a few questions about the types of unusual income. As an example, he asked about income from foreign trade.

Based on your answers in the Deductions and Contributions section, the software will recommend a specific or general deduction. This is the same with tax software and I would generally trust H&R Block's recommendations.

As with most trusted tax software services, this one uses bank-grade encryption technology to ensure your information is secure during storage and transmission to the IRS. It also encrypts data from your web browser to H&R Blocks servers and uses multi-layer authentication to ensure you're logged in.

H&r block online chat, h and r block, h&r block online, h&r block, h&r block filing online, h&r block online taxes, h&r block online chat support, h and r block online, h&r block chat, h and r block online chat, h&r block live chat, h&r block online live chat

0 Comments